According to LHDN foreigners employed in Malaysia must give notice of their chargeability to the Non-Resident Branch or nearest LHDN branch within 2 months of their arrival in Malaysia. Pindaan yang dibuat akan.

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Here are the income tax rates for personal income tax in Malaysia for YA 2019.

. 这一次要跟大家谈到是减免项目 Pelepasan Cukai 和扣税项目 Potongan Cukai如果你是大马公民那么你就要留意哦呈交报税表格时我们可以会看到减免项目如个人电脑书籍运动用具保险费用父母医药开销身体医药检查等等可是这些减免的数. Understanding Tax Rates And Chargeable Income. - Hantar surat rayuan nyatakan bahagian kesilapan ke cawangan selian fail cukai pendapatan anda dengan menyertakan sekali salinan e-borang serta dokumen berkaitan seperti penyata pendapatan EAEC dan resit asal untuk tuntutan pelepasanDan harus diingat pindaan yang dibuat selepas 6 bulan akan tertakluk kepada penalti.

Function Added For Excel Users To Do Ea Form Actpay Payroll

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Ea Form Malaysia Form Ead Faveni Edu Br

Ini Kisahku Suka Duka Bersama Insan Insan Tersayang Pssstt Korang Dah Dapat Borang Ea

Cara Isi Borang Ea Form Otosection

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Ini Adalah Borang Ea Form Untuk Anda Isi Cukai Pendapatan Di Website Efiling Lhdn Myrujukan

Muhammad Faris Tech Hr Posts Facebook

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

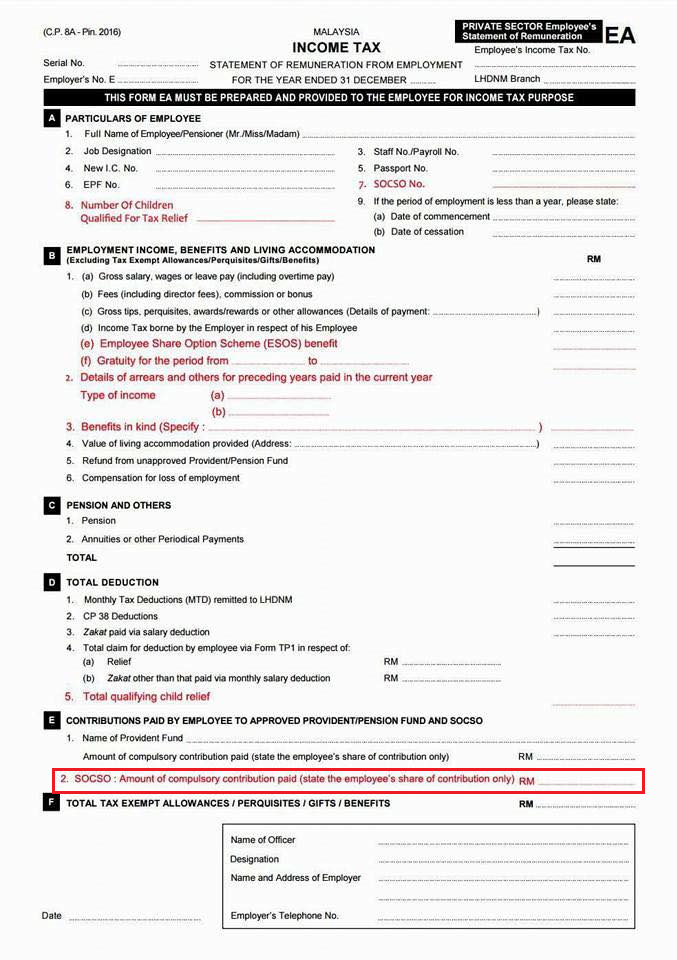

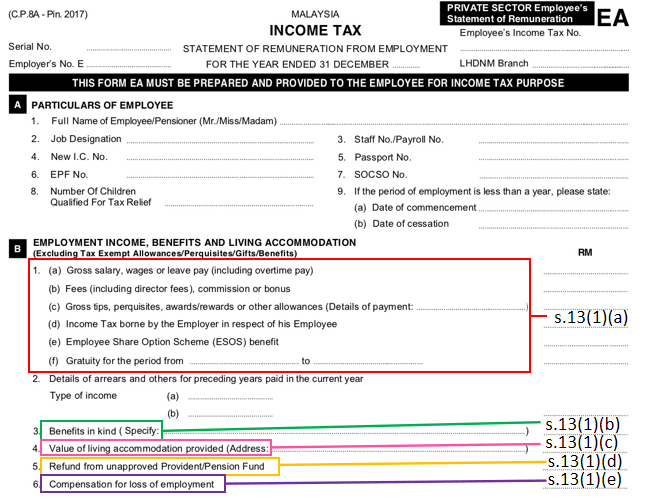

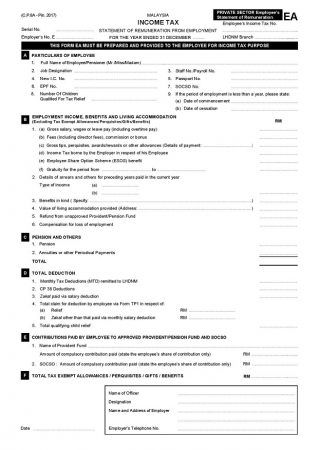

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

Ea Form 2021 2020 And E Form Cp8d Guide And Download

Edayu Co Chartered Accountant Reminder For Prepare Form E It Is Time To Start Preparing The Form E Employer S Responsibilities If You Have An Employee During Last Year

Borang Ea 2020 Untuk Majikan Youtube

Ini Kisahku Suka Duka Bersama Insan Insan Tersayang Pssstt Korang Dah Dapat Borang Ea